Authored by: Federico Fabbri, Clark O’Niell, Geoffrey Cheung, Ori Perlman, and Heiner Himmelreich

For IT leaders, efficient growth is the name of the game. That’s the key takeaway from Boston Consulting Group’s latest IT Spending Pulse, conducted in collaboration with GLG, an insight network that provides access to expert perspectives, which surveyed hundreds of senior IT buyers to identify the key trends and priorities for European and North American business leaders.

When we last surveyed IT leaders in Q4 2022, we saw signs of slowing investment as leaders sought leaner growth. That trend continues in this year’s IT Spending Pulse, with buyers seeking to drive top-line growth while simultaneously keeping total IT spend under control.

Notably, however, this year’s IT Spending Pulse finds organizations of all kinds investigating the strategic implications of emerging technologies such as GenAI. In this context, IT buyers are working to strike a new balance: making the robust investments needed to support innovation and growth, but framing those investments within a restrained and even somewhat conservative approach to managing total IT spend.

Overall, our respondents see IT spend remaining relatively stable, with only modest increases expected as businesses head into 2024. Risk management and analytics remain top priorities, consistent with prior years, as companies seek to drive strategic advantage while effectively managing cybersecurity threats.

The larger shift for IT buyers, as might be expected, stems from their companies’ increasing focus on AI and machine learning — and especially GenAI, which emerged as a key priority for many businesses in 2023. In total, 35% of respondents are now actively exploring GenAI solutions, and companies expect to dedicate an average of 4% of their total IT budget to building out and supporting GenAI initiatives.

Even here, though, IT buyers remain cautious and committed to making efficient investments. While GenAI solutions have been prominently piloted in IT and customer service functions, especially in the tech and finance spaces, many executives believe the business case for GenAI is not yet fully proven. Managing that tension, and capturing new growth opportunities without overcommitting to untested technologies, could emerge as the defining challenge for IT leaders in the coming year.

The IT Spending Pulse survey was conducted during Q2 of 2023, and captures insights from ~360 IT buyers at the Director or Senior Director level or higher, each selected for their clear view of their organizations’ IT priorities and overall budgetary planning. The respondents span diverse industry verticals and geographies, with 60% of respondents from North America and 40% from Europe. The IT Spending Pulse focuses on large (>$1B) and mid-sized companies, with approximately 65% of respondents leading IT spending at large enterprises and 35% holding roles at mid-sized companies.

With that in mind, let’s take a closer look at the key trends seen in this year’s IT Spending Pulse:

1. IT leaders remain focused on cost control

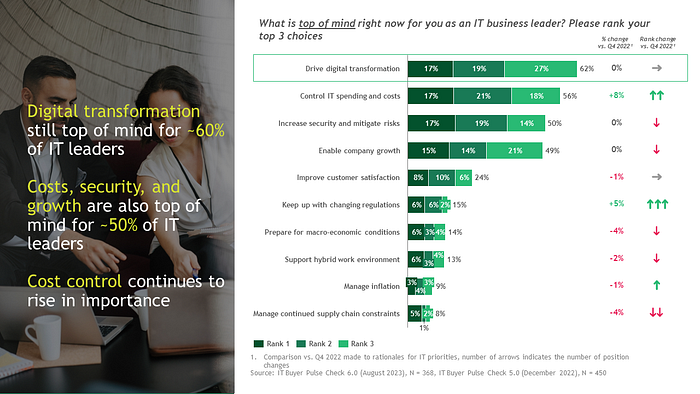

The new IT Spending Pulse shows that IT leaders are paying close attention to cost control. As in previous surveys, buyers’ top priorities have remained largely consistent, with a strong focus on driving digital transformation, increasing security and mitigating risks, enabling growth. Of these three key priorities, the need to enable and support digital transformation remains the top concern for IT leaders, with around 62% of respondents naming it as a top priority.

One important shift in IT leaders’ priorities emerges from the survey. While leaders’ commitment to driving transformation, maintaining security, and enabling growth remain unchanged, the need to control costs has gained significant new traction. In fact, cost control is now IT buyers’ second-highest priority, secondary only to driving digital transformation, with 56% of leaders indicating that managing costs effectively is top of mind for them.

The precise weight given to cost control versus investment in growth varies significantly by industry. Education, banking, and travel and tourism leaders tend to focus more on keeping costs down, while IT buyers in the professional services, media, and retail spaces are markedly more willing to prioritize growth over the need to limit IT spend.

2. A small uptick expected for IT spending in 2024

Given leaders’ focus on controlling IT costs, it should come as no surprise that overall IT spend is expected to grow only slightly heading into 2024.

In the previous IT Spending Pulse, in Q4 2022, 19% of IT buyers said they anticipated decreases in their organization’s total IT spend. This year, respondents were slightly more bullish, with only 15% anticipating a decrease in their IT budgets. Overall, almost three-quarters of IT leaders expect their spending to increase year-over-year, a four percentage point increase from our previous report. Still, such growth will come at a modest pace, with an average predicted increase in IT spend of just 2.9% — a growth rate slightly below that found in previous editions of the IT Spending Pulse.

Respondents see AI and machine learning, including GenAI, as the top area for new IT investments, with the proportion of leaders anticipating increased spending on AI technologies jumping by 18 percentage points from Q4 2022. Cloud services, security infrastructure, and analytics are also top investment priorities for IT leaders. Despite their broader focus on cost control, many purchasers will continue to adopt a best-of-breed approach when investing in these mission-critical areas.

Read more: